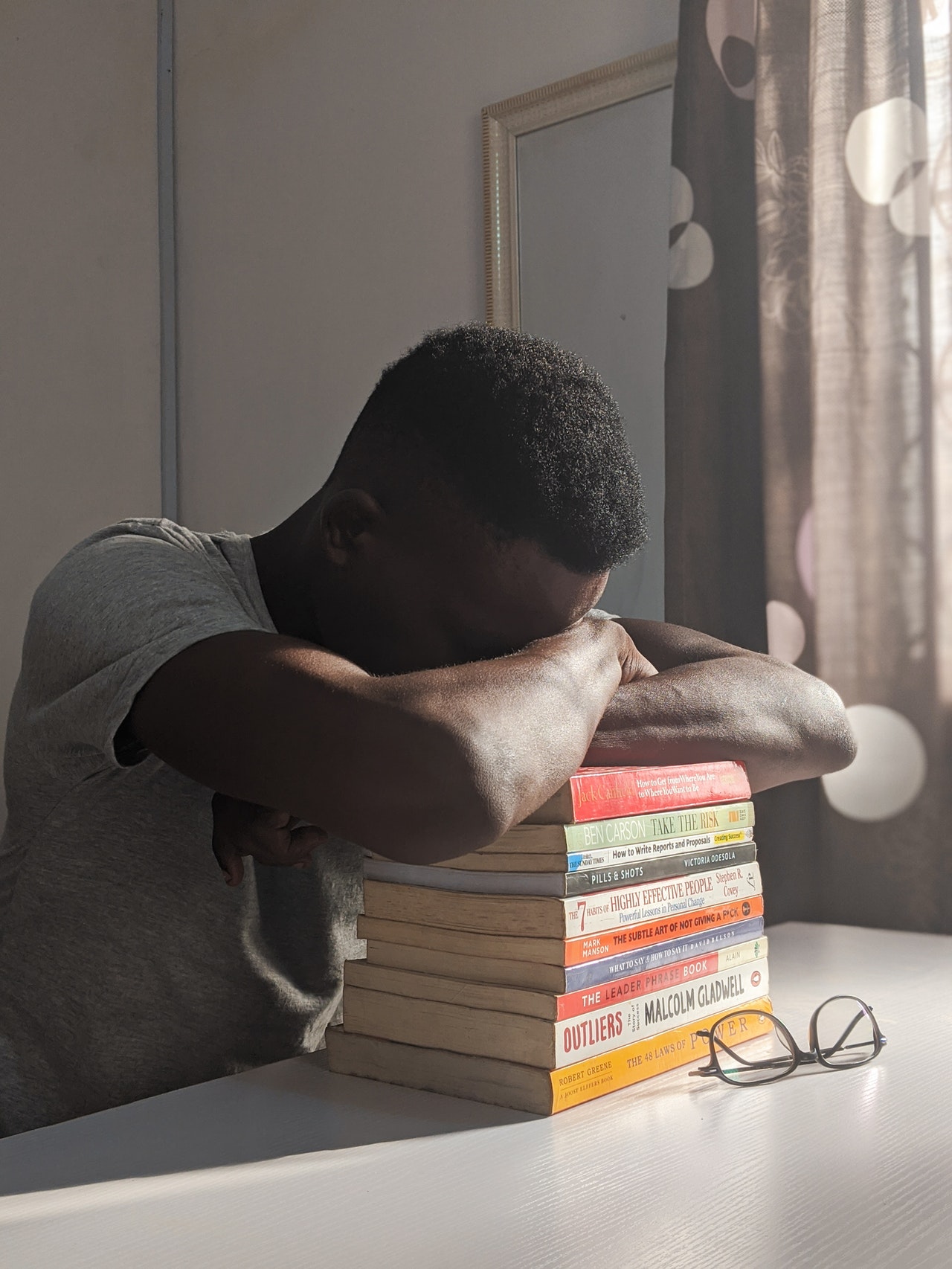

For many families, in particular the black community, going to college is like a badge of honor. For some, attending college is a family tradition; and for others, the opportunity to be a first generation college graduate is a milestone that those before only dreamt of. My mother was a first generation college graduate and an educator for over 34 years. Although I don’t recall her ever saying that my siblings and I had to attend college, we never discussed any other options either. I knew attending college would be an opportunity to experience life outside my 32sq mile island but I never considered how expensive it would be to actually attend or how we’d pay for it. This is the reality that many families find themselves in.

I went on to earn a Master’s degree that was thankfully funded by a Graduate Fellowship and, without missing a beat, I started paying back my student loans once I attained employment. I never stopped to think about the fact that I owed thousands of dollars in student debt hanging over my head. For some reason, I had normalized having student loans and in today’s society this has become the norm. Every month I paid towards my loan and paid a little extra here and there to help bring the principal balance down faster but what I failed to acknowledge were the missed opportunities. I was paying my debt rather than funding a dream. Perhaps that money could have gone towards startup costs for

a business or investing in real estate, or even a sizable down payment on a house. Regardless, opportunities that could have been used to propel me economically were being used to pay for student loan debt I began taking out at 17 years old.

Don’t get me wrong, not paying my loans was never an option for me. From childhood, it was ingrained that if you owe someone you should always pay them back. It’s an integrity thing for me but here is how it gets tricky. We’ve heard the sound bites of the U.S. student loan total being over $1.5 trillion. According to the Federal Reserve, 20% of Blacks and 23% of Hispanics are behind on student loan payments versus Whites at 6%. There is an economic disparity between races and ethnicities regarding student loan repayments. Now there are a number of factors that influence this but the undeniable result is that Blacks and Hispanics, in many facets of life, are economically behind in comparison to White counterparts. The harsh reality is 85% of black college graduates took out student loans to fund their undergraduate degrees and almost 49% from cohort class 2003-2004 defaulted by 2016, according to the Center for Responsible Lending, a non-profit in Durham, N.C.

Now I am in no way discouraging minorities from seeking a college education, but what I am challenging is the manner in which we do so. Attending college is a personal investment and, in any investment opportunity, you shouldn’t take part in something you don’t understand. Doing your research on these 4 things will make your educational investment worth it:

- Conduct thorough research on what careers are in demand. Being able to secure an “in demand” career increases your likelihood of landing a job with a great salary and benefits.

- Research different ways to fund your education. Seek scholarships, grants, and work-study opportunities. Working to pay your way through school is a good option as well.

- Determine what college or university is right for you. Oftentimes, people don’t consider community colleges or public institutions of higher learning. The tuition is far less than private institutions and for-profit colleges.

- Don’t feel pressured into going to college. Trade schools, the Military, and entrepreneurship are amazing options to pursue as well. So don’t take out tens of thousands of dollars in student loans just to realize that college was not for you.